Real Estate Prices in Hyderabad Surged in 4 Years

Hyderabad leads with an 80% housing price surge in four years, while Chennai is the most affordable and Mumbai the least. Affordable homes dip.

DECLINING AFFORDABILITY

Post-pandemic, property values have nearly doubled, especially in Hyderabad and Noida. This price trend is driven by high housing demand combined with limited supply. Over the past 4 years, soaring prices have been fueled by robust economic growth, increasing urbanization, and a growing population with homeownership aspirations.

This has led to declining affordability, making it harder for many to enter the Indian real estate market. In 2024, affordability stands at Rs 80 lakh to 1 crore. While affordability weakens, buyers’ sentiment toward purchasing a house for societal status remains high.

The declining affordability has upset the balance of the price-to-annual household income ratio (P/I Ratio) across the country. According to Magicbricks, the average Indian P/I ratio increased to 7.5 in 2024 from 6.6 in 2020, well beyond the global benchmark of 5.0. This indicates that real estate in India is becoming increasingly unaffordable each year.

RISING LUXURY

Anarock Research reported that the Indian real estate market saw an 11% decline in housing sales during the third quarter of 2024.

In terms of budget segments, the luxury housing segment above Rs 1.5 crore accounted for 33% of new supply, followed by 30% in the premium segment above Rs 80 lakh, and 23% in the mid-segment above Rs 40 lakh. The affordable segment fell below 13%, marking the lowest in a quarter.

HYDERABAD REAL ESTATE

The demand for residential real estate in Hyderabad and Bangalore is commonly driven by IT/ITeS professionals. Additionally, Hyderabad’s suburbs are experiencing a surge in demand. Medchal is an emerging real estate destination, where the average price for apartments has increased by 32% in the last 4 years.

About 12% of properties for sale in Medchal fall in the Rs 1-1.2 crore range, while 13% of properties are priced above Rs 60 lakh. The area is seeing higher demand for residential plots (37%) and apartments (31%). Entering the real estate market with trusted developers like Avani Builders guided by expert realtors like TheCeyone can make a whole lot of difference in investment. Properties like Avani Moukthikam and Avani Advaitha in Medchal in proximity to the top 15 international schools and major corporate and IT hubs are a great investment choice.

Mokila has recently emerged as a preferred choice for premium lifestyles. Real estate trends in Mokila have surged by an estimated 10.24% year-over-year. Located just 15 minutes from Neopolis SEZ at Kokapet, Subishi Fortuna Tower offers a golden opportunity to save Rs 1 crore on 3 BHK apartments in Mokila compared to Kokapet.

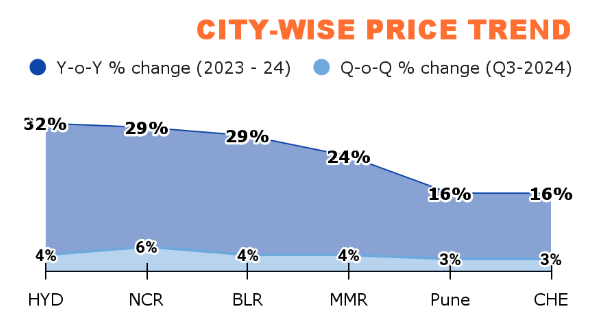

Among the top 7 cities, Hyderabad recorded the highest annual price increase of 32%, followed by Bengaluru and NCR with 29% increases each. Quarterly, prices in the top 7 cities rose by an average of 4%.

According to a Magicbricks survey, Indian real estate prices have surged by 46%, with Hyderabad seeing a substantial increase of 78.6%, followed by Noida at 69%. Additionally, home loan interest rates shifted to 9.1% in 2024 from 7.35% in 2020.

Tech cities like Bangalore and Hyderabad are experiencing massive real estate market growth in 2024. According to Anarock Research, post-COVID-19, property prices in and around Kokapet, near Hyderabad’s airport, increased by 89%, while property costs on Sarjapur Road in Bangalore leapt by 58%.