The Rise of Co-Living Spaces: A New Trend in Urban Real Estate

Co-living spaces, the preferred alternative to skyrocketing urban rented apartments, are projected to reach a market size of 40 billion USD by 2025.

The Indian co-living market is projected to increase to 5.7 million bed capacity by 2025. The flexible lifestyle and affordable housing options in the city centre drive the love for co-living spaces among students and migrant young professionals. I

Cushman & Wakefield India reports that the market is expected to grow at a compound annual growth rate (CAGR) of 17% between 2020 and 2025, reaching a market size of USD 40 billion.

How did the Co-living market perform during the pre-covid scenario and what is the current state in India?

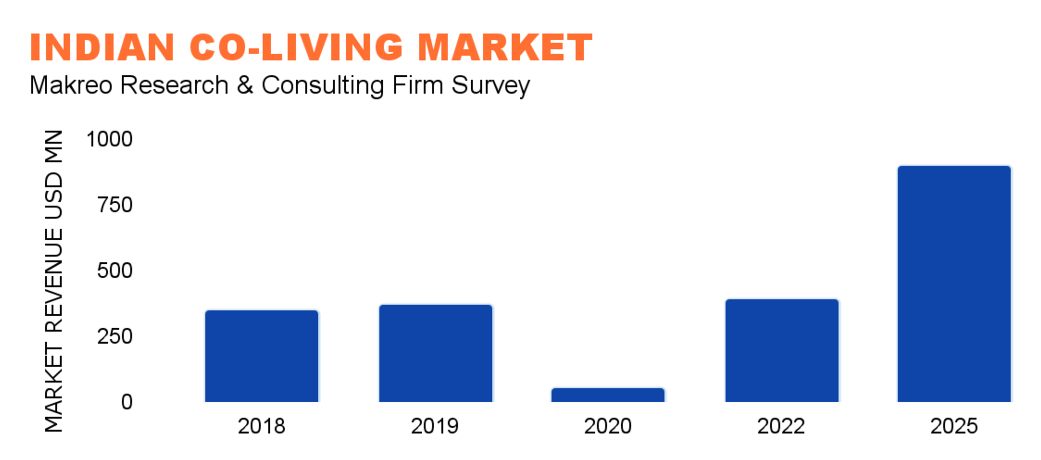

The co-living market was booming during the pre-covid scenario, particularly in urban centres like Bengaluru, Mumbai, Pune, Delhi-NCR, Hyderabad, and Chennai.

Of course, the pandemic caused a slowdown in demand as many people left cities due to lockdowns and work-from-home provisions. In 2022, cities recovered with stringent measures for safety and healthcare, professionals returned and the co-living market picked up the pace.

What is the role of students and professionals in the Co-living market in India?

As per the Delloite Global Millenial Survey, the average tenure of millennials in their jobs is 3 years at most and most prefer to travel across cities for work. Millennials are digital nomads– not ready to put down roots, yet enjoy travelling and working remotely across locations. This is driving the co-living trend in India.

Educational and business hubs are often located in or near large urban centres. The accommodations in and around these hubs are quite expensive, especially for students. Co-living spaces address this gap by offering convenient, budget-friendly options with essential amenities like Wi-Fi, common areas, and cleaning services to attract students.

Furthermore, 50% of the Indian population comprises Gen Z which will propel this trend of co-living spaces to a greater height. India is the World’s third-largest start-up hub. The young workforce is willing to relocate to other cities for job assignments.

What are the major factors driving the Co-living industry in India?

What millennials love about co-living space is the personal space it offers with quality stay, a powerful sense of community and privacy. The living arrangement, private or shared rooms, comes with shared common spaces for interaction.

Co-living spaces are completely autonomous on entry and exit with no interference from the landlord or operator. There is no gender discrimination. Few Co-living offers a complete package of Wi-Fi, housekeeping services and modern amenities.

What’s more, co-livings have low entry costs, may be flexi-deposits, and have no brokerage and affordable rentals in a highly desirable housing market.

What is the expected future of the Co-living market in India?

The future of the co-living market in India is promising. With the expected increase to 5.7 million beds by 2025 and continued urbanisation, demand for co-living is projected to rise steadily. As more students and young professionals move to urban centres, co-living is likely to become a preferred housing option due to its affordability, convenience, and flexibility. Additionally, evolving lifestyle trends and the need for flexible living arrangements will fuel further growth in the sector.

What is the investment scenario in the Indian co-living market?

The co-living market is becoming an attractive investment opportunity, with domestic and international investors showing interest and bringing much-needed seed capital and funding.

Companies like NestAway, Oyo Life, and Stanza Living are attracting funding to expand their operations and increase bed capacity. Investors such as Nexus Venture Partners, IDFC Alternatives, Mirae Asset, Trifecta Capital, Goldman Sachs, Flipkart, InnoVen Capital, Hero Group, Airbnb, and Salarpuria Satva Group, etc., are also drawn to the relatively untapped potential in tier-2 and tier-3 cities, where co-living is starting to gain traction.

Who are the major players in India’s Co-living market and key performance areas?

NestAway offers a wide range of affordable co-living spaces for young professionals across multiple cities including Bengaluru, Mumbai, Delhi NCR, Thane, Navi Mumbai, Pune, Hyderabad, Mysore, Kota, Bhubaneswar, Visakhapatnam, Coimbatore, Kolkata and Chennai.

Oyo Life focuses on budget-friendly co-living options and has a large presence in urban centres like Delhi NCR, Bengaluru, Pune, Mumbai, Hyderabad, Chennai, Kolkata, Jaipur, Coimbatore and Mysore.

CoHo targets young professionals with tech-enabled, community-driven co-living spaces in Delhi NCR and Bengaluru. Stanza Living specialises in student housing, offering high-quality accommodations near universities.

StayAbode, CoLive, ZiffyHomes, Zolostays, House, Grexter, YourOwnRoom, and YourSpace also provide a range of co-living options in Delhi NCR or Bengaluru, focusing on amenities, flexibility, and convenience. These companies have positioned themselves as key players in the growing co-living market, providing flexible and affordable housing solutions for India’s urban population.