Bengaluru: India’s Tech Boom Fueling a Real-Estate Surge

In recent years, Bengaluru has transformed into much more than India’s famed IT hub. With a booming startup ecosystem, a swelling venture capital influx, and a sizable working-age talent pool, the city is now reshaping its residential and commercial real estate landscape. And for home-buyers and investors alike, that shift presents an opportunity worth paying attention to.

Tech Strength: A Solid Foundation

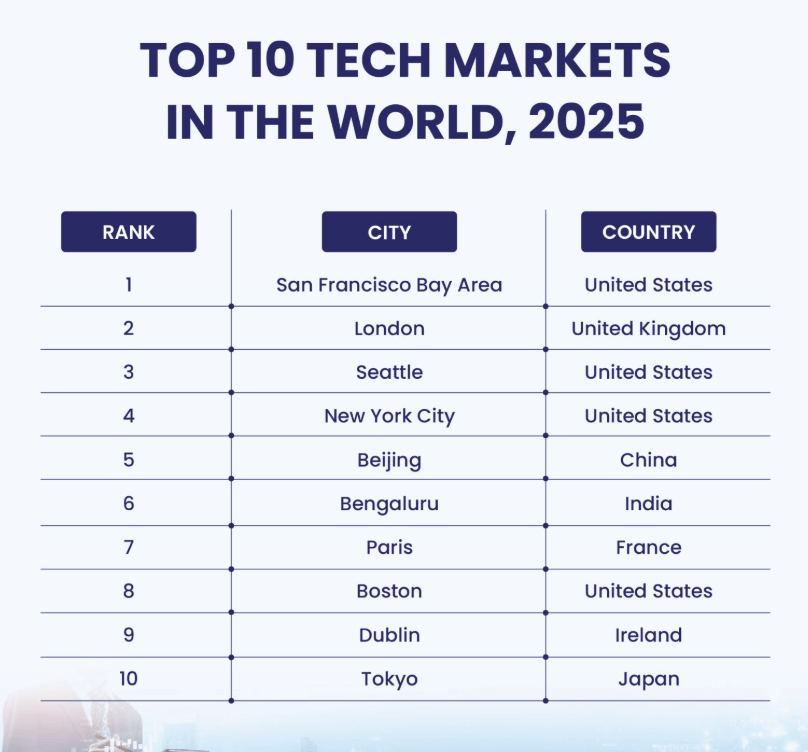

The story begins with Bengaluru’s technology ecosystem — and its momentum is impressive. According to the real-estate consultancy CBRE, Bengaluru is now classified among the top global tech powerhouses. Its tech workforce has crossed the 1 million mark, making it one of the largest in the Asia-Pacific region.

Key highlights:

- Bengaluru is home to around 28 unicorns, a strong indicator of its startup clout.

- In 2024 alone, the city attracted some $3.3 billion in VC funding, across 140 deals (including 34 deals focused on AI).

- The working-age population (which feeds tech and services) grew by about 2.4% between 2019-24 — a high global rate.

Bengaluru ranks #6 among the world’s top global tech markets in 2025, standing ahead of cities like Paris, Boston, and Tokyo.

Why Real Estate Is Riding the Momentum

When a city attracts talent, investment, and corporate activity, the need for housing, office space, and amenities inevitably follows. Bengaluru’s real-estate market is tapping into exactly that.

Here are the dynamics at play:

1. Demand from professionals & companies

As tech firms, startups, and global capability centers expand in Bengaluru, they bring people who need housing, and they need infrastructure. That creates demand for quality residential stock in areas that are well-connected and offer lifestyle value.

2. Infrastructure & connectivity driving value

New metro lines, ring-roads, suburb expansion, and peripheral growth zones are opening up the map. Not just the traditional central locations — the growth corridors (north, east, south) are seeing heightened interest.

For example, developers point to the north and east corridors of Bengaluru as hotspots thanks to infrastructure momentum.

3. Shift in buyer/investor mindset

It’s not just about a roof anymore. Buyers are looking at amenities, smart-home features, green space, connectivity, and hybrid-work-friendly homes. And investors are looking at yield plus appreciation in emerging micro-markets rather than simply central ones.

4. Commercial and hybrid real-estate growth

With tech and startups proliferating, office/IT-park demand remains strong — albeit with shifting formats (co-working, flex-spaces). That commercial growth tends to spill over into the residential realm: people want to live near where they work, or at least have options.

What This Means for Investors & Homebuyers

For someone considering buying or investing in Bengaluru right now, here are some takeaways with a human tone:

- It’s about being part of the trend. If the city is attracting global and national tech players, you’re aligning with that upside — both in value appreciation and rental demand.

- Location matters more than ever. Peripheral suburbs with good connectivity may offer better value today than traditional central zones.

- Think 5-7 years ahead. Real-estate gains aren’t always overnight (especially in emerging areas). Many market analysts suggest a holding horizon of 5-7 years to see meaningful appreciation.

- Quality counts. Smart homes, eco-features, and modern amenities matter: they reflect the upgraded buyer’s lifestyle and can help future resale/rental.

- But stay grounded. No city’s boom is free from risk. Infrastructure delays, oversupply in some pockets, and rising construction costs can temper expectations.

Home‐buyer’s checklist: What to weigh before you commit

Because yes — while the momentum is strong, smart buying means being discerning. Here are some human, practical points:

- Connectivity & commute: Your home should be near good transport links, metro, ring-roads, or upcoming stations. The difference in daily life is huge.

- Developer & delivery credibility: Always check track record, construction status, and transparency.

- Lifestyle & amenities: If you’re working in tech or want a home that supports your lifestyle (work from home, smart controls, wellness features), check what’s really offered.

- Resale/rental potential: Even if you are buying to live, good resale or rental value is a bonus. Tech corridors often yield better rental demand.

- Future-proofing: Infrastructure plans matter. Areas set to benefit from new metros, roads, or infrastructure upgrades often show stronger appreciation.

- Segment & budget fit: Mid-segment families and young professionals are driving much of the demand in Bengaluru. Choose accordingly.

A snapshot of what your future could look like

Imagine: You’re living in a 2- or 3-BHK apartment in a well-planned township near the outer ring road or in North Bengaluru. You’re a tech professional (or working hybrid) and you’re a 20-minute drive or metro ride away from your tech park. You come home to smart lighting, a well-landscaped garden, coworking lounge on the block. On weekends, you hit a café nearby, and around you are good schools and future infrastructure. Meanwhile, the property you’ve bought has already appreciated by ≈ 10 %+ in value in a couple of years, and you’re renting it out for yields in the 3.5%-5% range if you ever choose to.

This is not a dream—it’s the scenario many are positioning for in Bengaluru right now. Reports show rental yields of 3.5%–5% in key tech corridors.

A Bright Outlook — With Eyes Open

The words “booming market” might sound a little overused, but in Bengaluru’s case, they seem justified. The convergence of tech, talent, infrastructure, and real-estate supply means we’re witnessing more than just incremental growth: we’re seeing structural change.

That said, wise decisions will come from balancing enthusiasm with caution. For example: choosing the right micro‐location, factoring in connectivity, looking at rental yield if you’re investing, and verifying the developer’s credentials — especially as more projects sprout in the periphery.

Conclusion

If you’re looking for where India’s growth story is playing out — not just in offices and startups, but in neighborhoods, homes, and communities — Bengaluru offers a compelling chapter. The tech ecosystem is vibrant, but what makes this relevant for you (or for someone thinking of a home/investment) is the collateral real-estate momentum.

In a way, buying a home or investing in Bengaluru right now is aligning with the city’s next wave: more jobs, more talent, more infrastructure, and more people wanting to live, work, and thrive here. If you pick wisely, you’re not just buying a property — you’re buying into the city’s evolution.

Resources

- State of Bangalore Real Estate Market 2025 – Propsoch. propsoch.com

- commercialdesignindia.com

- CBRE

- Hindustan Times

- Lodha Group

- The Times of India

- websitemedia.anarock.com

- starrbites.com

- Bangalore Real Estate Outlook: Property Prices in 2025 – MoveInProperties. (Move In Properties)