Property Registration in Bangalore: All About the New e-Khata Rule

Buying, selling, or owning property in Bangalore just became more structured and transparent. Starting 1st October 2024, the Government of Karnataka has made e-Khata mandatory for all properties in Bangalore. This means that every property transaction – whether buying, selling, transferring, or registering – must include a valid digital Khata (e-Khata).

For property buyers and owners, this rule is not just another formality. It is a big step toward accountability, transparency, and fraud prevention in Bangalore’s booming real estate market. In this blog, we’ll explain what it is, why it is important, how to get it, and how this mandate will impact property transactions.

What is e-Khata?

A Khata is a property account document issued by municipal authorities like BBMP, showing property details such as:

- Owner’s name

- Property size and location

- Built-up area

- Property tax assessment

Traditionally, there were two types of Khata:

- Khata A – for legally approved properties with clear tax records.

- Khata B – for properties with irregularities or incomplete approvals.

Now, the government has digitized this system into e-Khata, a unified online property record. It contains the same details but is stored electronically, allowing for greater accuracy, transparency, and accessibility.

Why is e-Khata Mandatory for Property Registration in Bangalore?

Traditional paper-based systems had multiple issues: delays, missing records, and risks of fraud. By making e-Khata mandatory, the government ensures:

- Transparency in property ownership.

- Uniformity in records across the city.

- Fraud prevention as digital records are harder to manipulate.

- Easy access to property details for owners, buyers, and banks.

From 1st October 2024, property registration, sale deeds, and transfers cannot be completed without this document.

Penalties for Not Having an e-Khata

The Karnataka government has not announced any direct monetary fines for failing to obtain an e-Khata by the deadline. However, the consequences are significant:

- You will not be able to register, sell, or transfer your property without a valid e-Khata after 1st October 2024.

- Property transactions may face delays or cancellations, as sub-registrar offices will not process sale deeds without it.

- Lack of this document also means you cannot access loans or update ownership records, which could reduce the marketability of your property.

In short, there may be no direct fines, but without this document, you won’t be able to complete any legal property transactions, which is effectively the biggest penalty.

Role of e-Khata in Property Buying

For buyers, this is not just a document – it is proof of legitimacy. Here’s why:

- Confirms that the property is tax-compliant.

- Ensures the property is recognized by municipal authorities.

- Reduces risks of ownership disputes or hidden liabilities.

- Banks often require this document for home loan approval.

Simply put, an e-Khata acts as a safety shield for buyers.

Implications for Buyers and Sellers

- For Sellers: You cannot sell or transfer property without converting your Khata into this document. This applies to both Khata A and Khata B properties.

- For Buyers: Always verify whether the property already has this important document before purchase. If not, insist on the seller completing the conversion.

Without this, no sale deed or registration will be legally valid in Bangalore after October 2024.

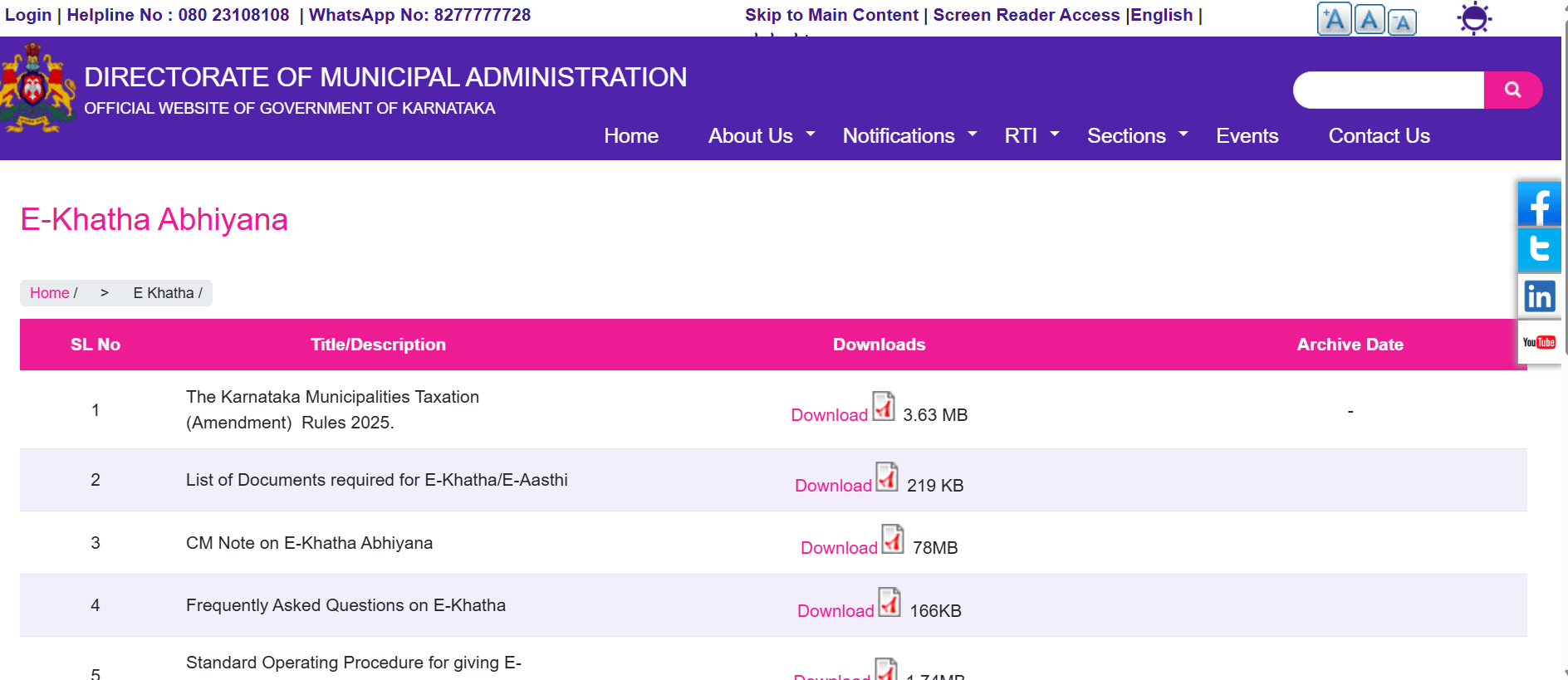

How to Get e-Khata in Bangalore (Step-by-Step)

The process is straightforward if documents are in order:

- Visit the e-Aasthi (urban) or e-Swathu (rural) portal.

- Create an account and log in.

- Fill the application form with property details.

- Upload required documents, such as:

- Sale deed

- Previous Khata (if available)

- Latest property tax receipts

- Proof of identity & ownership

- Sale deed

- Pay the prescribed fees online.

- Authorities will verify documents (sometimes including a field visit).

- Track application status online.

- Once approved, download the this certificate for official use.

Processing usually takes 15–30 days, depending on property type and document clarity.

Benefits of this document for Property Owners

- Digital ownership proof – secure and easy to access.

- Simplified property tax payment – directly through online portals.

- Smooth transactions – required for selling, mortgaging, or transferring.

- Fraud prevention – eliminates forged paper Khatas.

- Convenience – no need for repeated physical visits to municipal offices.

Challenges in Transitioning to e-Khata

While beneficial, some challenges exist:

- Khata B properties may require extra steps to regularize, delaying conversion.

- Discrepancies in old records could slow approval.

- Awareness gaps – many owners are still unaware of the mandatory deadline.

To avoid last-minute issues, property owners should begin the application early.

Impact of this Mandatory Document on Bangalore’s Real Estate Market

The mandate is expected to reshape property dealings in Bangalore:

- Properties with this valid document will see higher demand.

- Property values may rise in compliant localities.

- Buyers will gain greater confidence in property titles.

- Real estate consultants, banks, and developers will rely heavily on digital verification.

In the long term, this will lead to a more secure, transparent, and efficient real estate ecosystem.

Conclusion

The introduction of mandatory e-Khata in Bangalore is a turning point for the city’s real estate market. While the transition may pose short-term challenges, the long-term benefits far outweigh them – from fraud prevention and faster transactions to better ownership security.

For property buyers and owners, the message is simple:

- Get your e-Khata before the deadline.

- Verify e-Khata before buying any property.

This one document is now the foundation of smooth, secure, and legally valid property transactions in Bangalore.

About Ceyone

At Ceyone Marketing, we go beyond property listings to empower homebuyers with reliable insights and guidance. From verifying RERA details to highlighting premium residential projects, we make your home-buying journey simple, transparent, and stress-free. Whether it’s a villa, an apartment, or an investment property, Ceyone ensures every decision is backed by clarity and confidence.

FAQs

1. What is e-Khata?

A digital property record containing ownership, tax, and property details.

2. Why is it mandatory?

To enhance transparency, reduce fraud, and streamline property transactions.

3. Who must get e-Khata?

All property owners in Bangalore, residential, commercial, or institutional.

4. Can Khata A or B be converted to e-Khata?

Yes, through the BBMP portal or Citizen Service Centres.

5. What documents are required?

Sale deed, tax receipts, previous Khata (if any), and ID proof.

6. How long does it take?

Usually 15–30 days.

7. Can I register property without e-Khata after Oct 2024?

No. All registrations and transfers will require e-Khata.

8. Can I apply online?

Yes, through the e-Aasthi (urban) or e-Swathu (rural) portals.

9. What are the benefits?

Secure records, fraud prevention, easier tax payments, and smooth transfers.

10. Is it applicable to BDA properties?

Yes, it applies across BBMP, BDA, and other local bodies.

References

- E-Khatha Abhiyana E-Khatha Abhiyana — Directorate of Municipal Administration, Government of Karnataka

- The Times of India Times of India — “E-Khata: E-khata Mandatory For Property Registration From Oct”

- Hindustan Times Hindustan Times — “Five things you need to know about the Karnataka government’s e-khata mandate”

- The Times of India Times of India — “E-Khata mandatory for building plan approval from July 1 in Bengaluru”