15 Benefits of Real Estate Investment in India

There are numerous investment options available in the market. Nevertheless, real estate is the most prevalent choice among Indians. Why not? It offers various advantages, which are not possible with other opportunities. This blog explores the benefits of real estate investment in India. If you want to learn how a real estate investment can grow your wealth, read this blog.

Before we discover the advantages of real estate investment, Let’s look at the Indian real estate sector.

Overview of the Indian Real Estate Industry

The real estate sector plays a significant role in the economy of India. A report concludes that the Indian real estate market can reach USD 5.8 trillion by 2047. This value will be 12 times its current size.

The industry would have about 15.5% of the share of the GDP. Consequently, the Indian real estate market entices both domestic and foreign investments.

If you are still wondering why to invest in real estate, check out the following reasons.

15 Reasons to Invest in Real Estate

1. Consistent Rise in Property Values

One of the primary benefits of real estate investment in India is the potential for continuous increase in property values. If you keep an eye on the Indian real estate market, you will notice that property prices are steadily rising.

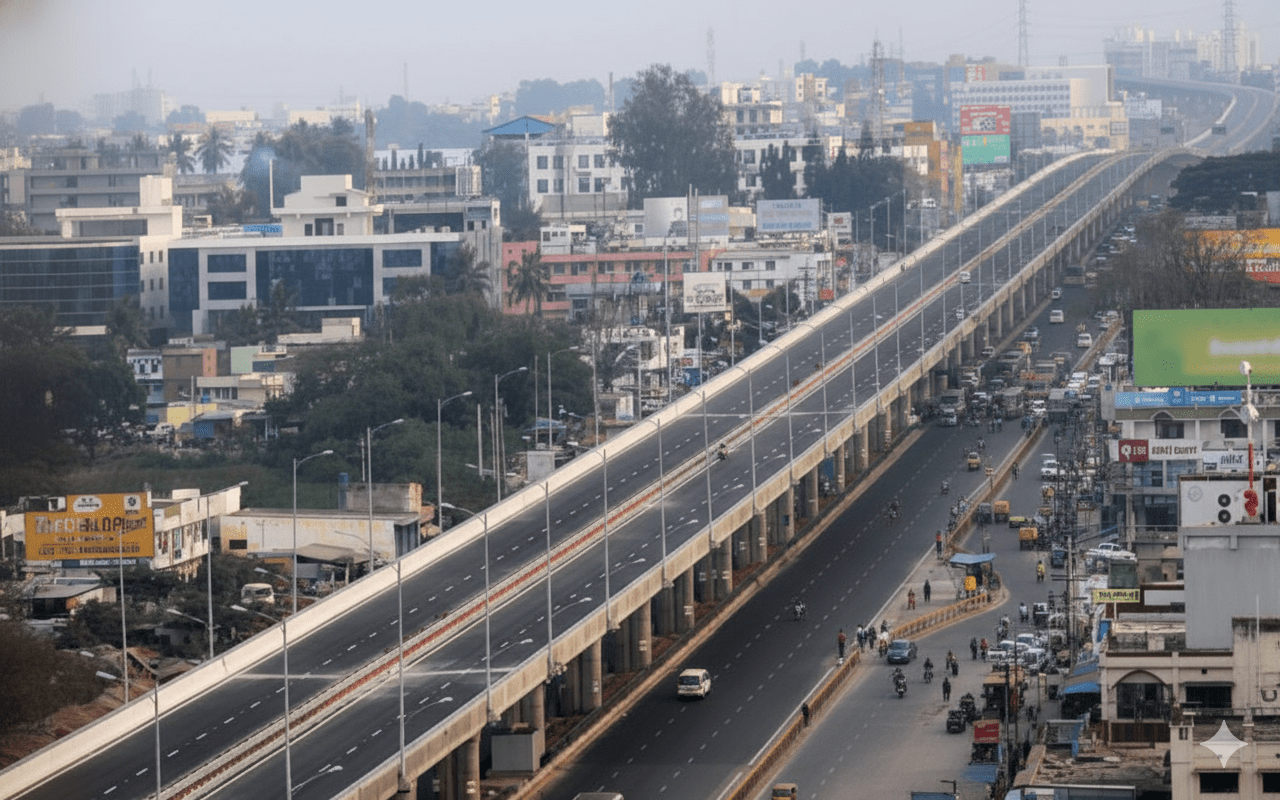

The property rates in cities like Delhi, Mumbai, Hyderabad, and Bangalore have significantly increased. If you follow the trend, it is the perfect time to invest in real estate.

It can give you substantial capital gains in the future. You will build equity and get high real estate returns.

2. Diversification of Investment Portfolio

Some investors also seek the advantages of real estate investment to diversify their portfolios. Individuals who want to reduce their portfolio volatility can benefit from investment in property in India.

Diversifying an investment portfolio with real estate has tons of rewards. Unlike stocks, the real estate market remains stable. Furthermore, this investment acts as a hedge against inflation.

Investing in real estate alongside bonds, stocks, and commodities is a wise investment strategy.

3. Passive Rental Income

Another advantage of real estate investment is that it can generate regular cash flow. You can get consistent passive income from your rental properties.

In metropolitan cities, the demand for rental properties is high.

You can expect high rental yields if you buy flats or apartments near IT hubs, educational institutes and industrial areas.

Investment in rental properties can secure your financial future.

4. Retirement Planning

Planning your retirement with real estate investment can be a smart move. It is one of the most undervalued real estate advantages. However, it can help you generate a decent income in your golden years. It can become a trustworthy source of passive income. If you are nearing retirement, consider investing in real estate.

5. A Way to Combat Inflation

With rising inflation, individuals are looking for ways to counter its effects. Investing in real estate can help you fight against the rise in the cost of living.

As the price of things uptrends, so do your property values and prices.

With real estate investment, you can maintain your purchasing power. Thus people can deal with the effects of inflation.

6. Tax Benefits

Several people are not aware, but investing in real estate has various tax benefits. The Indian government has been offering different tax aids for first-time home buyers.

For instance, individuals can leverage tax support under the section 80 C. Furthermore, you can also get a rebate on GST, depending on your eligibility.

7. Less Risky

One of the primary benefits of real estate investment in India is that it is both profitable and satisfying. Compared to bonds and stocks, it is less risky.

People looking for long-term investments can substantially benefit from investing in real estate. Current demographic trends and demand for housing ensure that real estate investment can offer massive benefits.

You might see some short-term market fluctuations. However, in the long run, the value of real estate properties will rise.

8. Wealth Creation

Investing in Indian real estate offers a favourable opportunity to create wealth. It is a time-tested strategy. There are various ways to make wealth via real estate investment. Over the period, your property will grow in value. Moreover, you can earn via rental. With your profit, you can buy more real estate assets.

9. Less Complicated Than Other Investments

Real estate investment is less complicated compared to mutual funds and stocks. If you work with the right real estate agent, things become effortless.

Nevertheless, with funds and stocks, you may need to conduct thorough research on historical returns and potential expenses.

Investing in real estate assets does not require you to study any algorithm. With a basic real estate understanding, you can earn high real estate returns in India.

10. You Get a Sense of Control

The real estate investment gives you complete control. You get full rights to manage your property. No one can decide other than you when to sell the property.

Besides this, you can choose the tenants and control the maintenance expenses on your own.

11. You Can Predict Cash Flow

It is not possible to predict exact profit with stocks and mutual funds. Fortunately, it is feasible with real estate investments. When you rent your flat or apartment, you know the precise cash flow you are generating. You can exclude the maintenance cost from it to learn the accurate profit.

12. Sense of Security

While it does not count as monetary benefits, buying a property offers various advantages. Since a real estate property is a tangible asset, it provides security.

For first-time home buyers, it is a moment of pride. In addition, a house provides you with physical safety and privacy.

13. Considerable ROI

A sizable return on investment is one of the primary benefits of investing in real estate. Investors often wonder what a good ROI in real estate in India is.

Well, people purchasing property in a prime location can expect a decent return on investment. According to the house price index of the Reserve Bank of India, the average annual return on real estate investment over the last decade was 11.6%. As negligible risk is involved, it is a good bet.

Overall, real estate returns in India are promising.

14. Multiple Investment Options

The benefits of real estate investment in India are multifaceted. It gives you multiple options to invest. For example, you can invest in plots, residential properties and commercial real estate assets. In addition to this, you can choose to put money in real estate REITs and crowdfunding.

15. Transfer of Wealth

Another advantage of real estate investment is that you pass it down to the next generation. It can be an outstanding financial decision in terms of legacy planning. Moreover, if you follow the proper wealth transfer strategies, beneficiaries can enjoy various estate tax benefits.

Conclusion

The benefits of real estate investment in India are diverse. Investors can leverage their real estate investments in several ways. From capital appreciation to rental income to portfolio diversification, real estate investment benefits are innumerable.

Although insignificantly, like every investment option, it also involves certain risks. Market fluctuations and economic downturns can be problematic sometimes.

As a result, you must seek the advice of real estate experts. Contact us now to invest wisely in real estate.

Frequently Asked Questions

Is real estate a good investment in India?

Yes, investing in real estate is beneficial in India. If you check the real estate trends, the market is continuously growing.

Property values are observing steady appreciation. Conduct thorough research on market conditions and the property location, you will get high returns.

Which real estate investment type is more profitable?Both commercial and residential real estate investments are profitable. Commercial real estate assets can give more returns in the long run. However, investing in such properties indeed requires a higher upfront cost. So you can make decisions based on your financial situation and goals.

Is real estate better than stocks in India?Both are entirely different investment options and come with various ins and outs. However, real estate investment has lower risk with decent returns.

Additionally, the property investment gives you regular and stable cash flow.

On the other hand, investment in stocks is unstable and unpredictable. Individuals looking for a safe alternative to stocks can consider real-estate investments.

What are the risks involved with real estate investment in India?Although the advantages of investing in real estate are huge, the market comes with some risks too. Some of the common risks of this industry include liquidity issues, market fluctuations, regulatory changes and more.

However, in comparison to other investment options, these are insignificant. We recommend conducting in-depth due diligence before making investments.

Can foreign investors invest in Indian real estate?Foreigners cannot invest in real estate development through LLPs, partnership branches and firms. Any kind of direct business in real estate is not allowed. Nevertheless, they can make investments via Indian companies.

What should I consider when investing in Indian real estate?The benefits of real estate investment in India are immense. If you take care of a few things, you can get massive returns on your venture. Some primary factors to ponder include:

- Market Conditions

- Location of Property

- Type of Property

- Regulatory Changes

As per the report of IMARC Group, the Indian real estate market is predicted to reach INR 6497.5 billion by 2028. Several factors are contributing to the growth of this industry. Some of the major ones include the growing population, urbanisation, economic growth, government initiatives and foreign investment. Considering the trend, we can say that the future of real estate in India is promising.